Combine your pensions

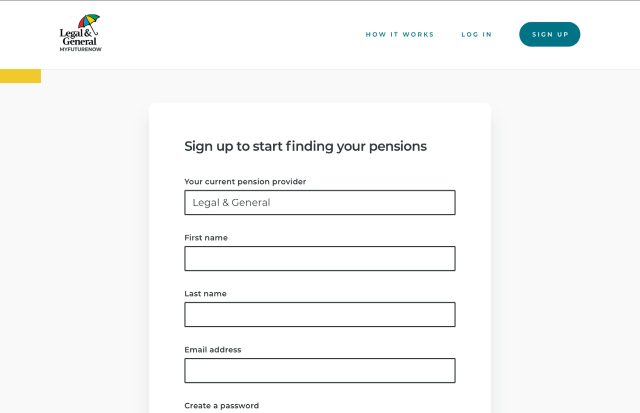

Transfer other pension savings into your Legal & General Workplace pension with our MyFutureNow service.

Our service

Combine your pensions

Having different jobs over the years may mean you have more than one pension pot out there.

Transferring these into your current Legal & General plan will keep everything in one place, so it's easier for you to manage.

You could also benefit from:

Lower charges - so you'll save money

More choice - investment options could be better

Better access - to help you manage your investments

Fewer providers - to save you time when making changes

How it works

- You provide us with some basic information and confirm we can speak to the other pension provider.

- We'll start processing your request.

- We'll be in touch once it's all done, or to discuss your options if we can't transfer it.

This service is completely free but any pensions you transfer will be subject to the same management charge as your Legal & General pension. Details of these charges are in your member booklet, which can be found on your scheme's website.

How it works

- You provide us with some basic information and confirm we can speak to the other pension provider.

- We'll start processing your request.

- We'll be in touch once it's all done, or to discuss your options if we can't transfer it.

This service is completely free but any pensions you transfer will be subject to the same management charge as your Legal & General pension. Details of these charges are in your member booklet, which can be found on your scheme's website.

- Are the fees and charges of your Legal & General pension higher or lower than the pension you're transferring? This can affect how your savings grow so check this before your start your transfer.

- Are there any benefits you might lose if you transfer? For example, protected retirement age or certain death benefits.

- Are there any penalties for transferring your pension?

- Are any features, retirement options or conditions of your Legal & General plan different to the ones in your old pension (e.g. investment choice)? Check you're comfortable with these before you transfer.

What happens to the pension you are transferring:

It will be paid in to your existing investment fund or funds and will be split in the same way as your regular contributions are invested.

If you don't currently pay contributions, it will be invested in your existing investment strategy.

Once your transfer is complete, you can change your investments any time.

The value of your pension isn't guaranteed and can go down as well as up.

Your pension savings will be invested in one or more investment funds.

Out of market period

There may be a short time where your money is not invested, whilst your pension is transferring. If the market rises during this time, you may miss out on a period of growth. Similarly, you may gain if the market falls.

Before making a decision, we recommend you read our

Guide to pension transfers

and all the documents relating to your Legal & General plan (you'll find these on your scheme's website).

You can also speak to an independent financial adviser - visit

www.unbiased.co.uk

to find one in your local area.

You may not be able to use this service if:

- You're in a Defined Benefit pension scheme, known as 'final salary' or 'average salary'

- Your scheme has a guaranteed annuity rate (GAR) or guaranteed minimum pension (GMP)

- You're invested in a with profits fund

However, if you've been given financial advice that specifically recommends you transfer one of these, please call us on 0345 070 8686 to discuss your options.

You may be able to transfer a Defined Benefit pension without a recommendation from a financial adviser, as long as it's under £30,000 and you understand the consequences of transferring it. Just get in touch so we can help.

Income Drawdown or Flexi-Access Drawdown schemes, where you've taken a tax-free cash payment on retirement and left the rest of your money invested (to take as regular/occasional income), are not transferrable.

Government (e.g. NHS or Teacher's) and International pensions are also usually not transferrable.